Skift hold

U.S. budget hotels took a hit in the first quarter as budget travelers appeared to spend less. Could inflation be the cause?

Sean O'Neill

U.S. budget hotels performed worse in the first months of the year than a year ago. Does this weakness indicate that some American travelers are feeling the effects of inflation?

U.S. economy-class hotels reported 6% lower revenue per available room in the first quarter than last year, according to CoStar STR, which received preliminary rate data for tens of thousands of rooms across the country. Brands like Econo Lodge, Days Inn, Super 8, and SureStay don't perform as well as premium brands.

| Chain Ladder Segment | Year-on-year growth for the first quarter |

|---|---|

| Total United States | 0.20% |

| Luxury | -0.30% |

| Top of the line | 3.00% |

| Top of the line | 0.40% |

| Upper mid-range | -2.00% |

| Midrange | -4.50% |

| Economy | -6.50% |

Source: STR.

Saying that performance is improving is not the same as saying that budget hotels are empty. For comparison, revenue per available room is slightly better than in the first months of 2019, before the pandemic hit.

Additionally, demand varies by market. Some Sunbelt cities, for example, are seeing booming demand, particularly from travelers working on infrastructure projects.

However, economy class properties recorded the weakest performance of all hotel segments.

“We view weak U.S. economy/midscale RevPAR as a concern for Wyndham and Choice hotels,” Patrick Scholes and Gregory Miller wrote in a report for Truist Tracks this week. “Based on STR/CoStar data, we calculate that WH's domestic RevPAR was down approximately 4.5% year over year in the first quarter and Choice Hotels' was down 3 .5%.

Analysts noted that they still like these companies' stocks for other reasons and must wait until the companies share their performance results in the coming weeks to draw firmer conclusions on trends.

Is inflation the bad guy?

Surveys paint a contradictory picture of travelers' feelings. Some demographic groups in the United States are facing cost pressures, which could impact their travel decisions this year, while wealthier Americans continue to spend a lot of money on travel.

A January survey of 2,000 U.S. adults in the general population, conducted by The Harris Poll for NerdWallet, found that only 45% of respondents planned to take a trip requiring a hotel or flight this summer. The survey found that 91% of respondents said they were changing their travel plans to save money.

More than half of the 2,200 travelers interviewed by Morning Consult for the American Hotel and Lodging Association say they are less likely to plan an overnight trip this year due to inflation.

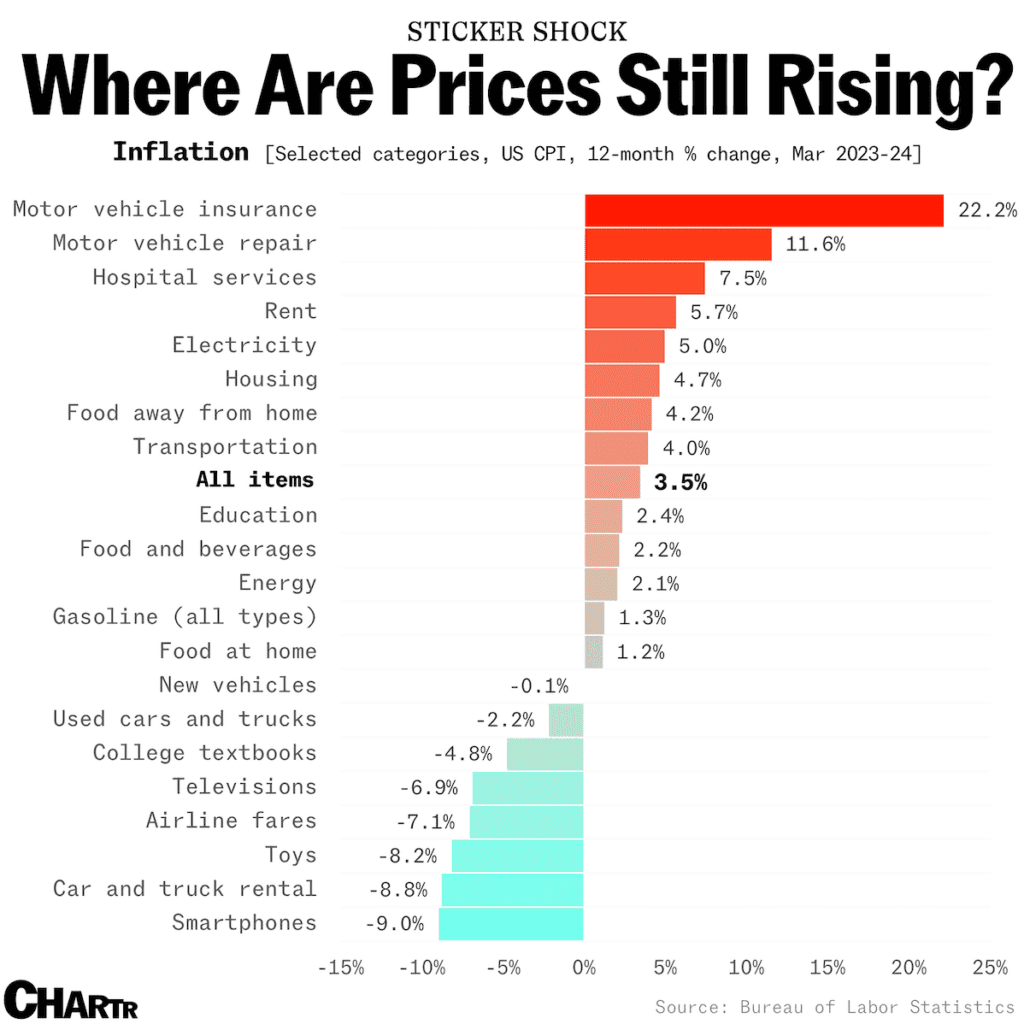

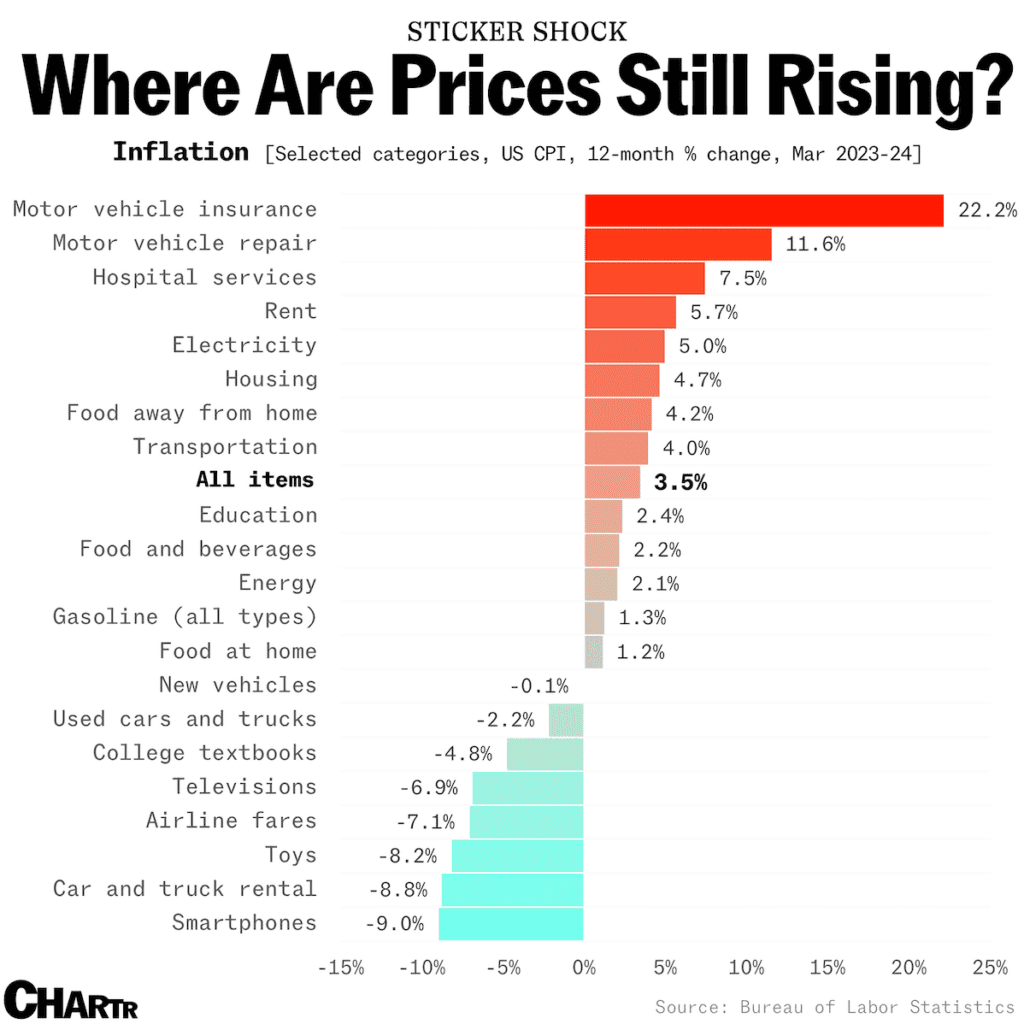

The inflation problem seems to stem from non-travel costs eating into people's travel budgets. The good news for people with stable incomes is that they could pay less for their plane tickets than they did a year ago. Average rates fell by 7% and rental car rates by 9%.

You would think that price pressure would encourage people to “swap” their hotels to cheaper ones.

Instead, people with fewer expenses tend to spend less or travel off-peak, thereby reducing their attendance at budget hotels.

Meanwhile, people with continued purchasing power prefer to spend on relatively high-end accommodation – according to trends Deloitte was first noticed in a survey last year.

Despite the slowdown in the lower-end segment of the hotel market, overall demand for hotels in the United States remains strong. Affluent Americans still seem to be planning big trips.

Exhibit A: A survey carried out in February by MMGY Travel Intelligence found that 76% of respondents who were affluent enough to take a trip last year planned to take a vacation this year – an increase from 70% a year ago.

Performance of the accommodation sector stock index since the beginning of the year

What am I looking at? The performance of stocks in the hotel and short-term rental sector within the ST200. The index includes publicly traded companies on global markets, including international and regional hotel brands, hotel REITs, hotel management companies, alternative accommodations and timeshares.

The Skift Travel 200 (ST200)Â combines the financial performance of nearly 200 travel companies worth more than a trillion dollars into a single number. See more hotels and short-term rental financial industry performance.