The car that takes you to the airport is part of a multimedia network. So is the screen in your plane seat. So is the app you used to book your trip.

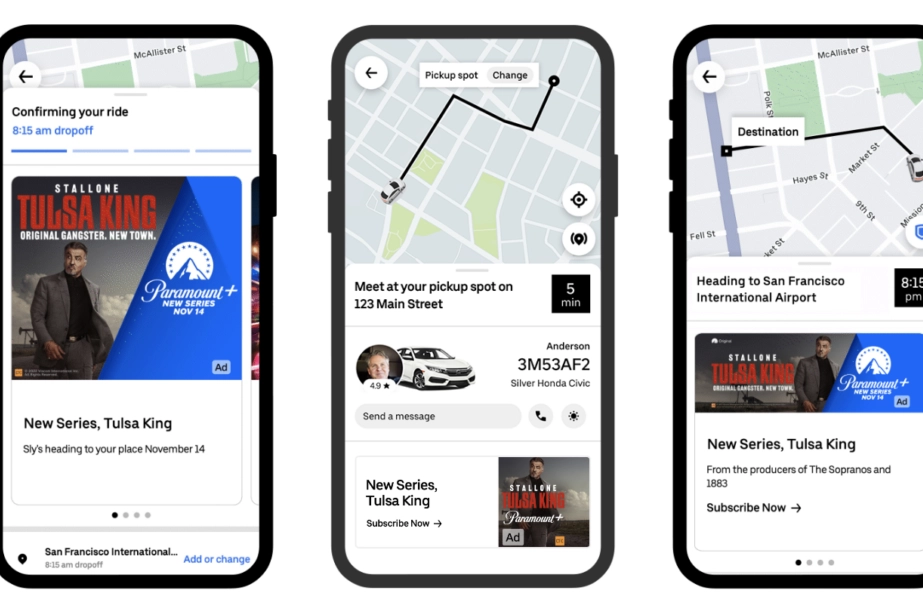

Retail media networks are no longer the domain of merchants who want to leverage shopper data and real-world locations to sell in-store advertising. Travel companies—hotel chains, airlines, and even ride-sharing companies—are leveraging the rich data they’ve collected from their customers and their connections to other verticals to give brands the ability to deliver personalized, contextual ads at scale in a post-cookie world.

“The retail media sector is exciting for a number of reasons,” said Matt Wurst, CMO of Genuina video provider that works with many brands and networks. For travel companies, he explains, these networks offer the opportunity to monetize their own media platforms by connecting brands with their audiences. And in addition to creating a revenue stream, the platforms also drive user engagement and time on site, which boosts ROI and other key performance indicators, Wurst said: “The audience is there, they’re receptive, and it’s a contextually relevant game where everybody wins.”

Retail advertising is on the rise, and spending in this segment is expected to increase grow by about 30% in 2024. The increase is largely fueled by these networks and their programmatic offerings, which are expected to generate $20 billion in spending, up from $7.5 billion in 2023. There is clearly a lot of money to be made; a conference call with analysts Last year, Uber CEO Dara Khosrowshahi said the company expects to generate $1 billion in revenue from advertising by 2024.

Travel companies have taken this lesson to heart. Marriott became the first hotel company to launch a retail media network, with the introduction of Marriott Media Network in 2022. The same year, Uber launched Travel Announcements and its rival Lyft introduced Lyft Media. And the ranks of travel NMRs continue to grow. United Airlines took the stage during Recent Cannes Lions The festival will showcase its new retail media network, Kinective Media. And Expedia’s travel platform has been launched Expedia Group Media Solutions at its annual conference in May.

Retail advertising has come a long way since the days of in-store displays and banner ads on e-commerce sites. McKinsey has estimated that the sector could grow by $100 billion in ad spending by 2026 and this new generation of commercial media now includes shoppable ads, addressable TV channels, and many other channels. And as McKinsey analysts noted: “The proprietary data and customer touchpoints held by hospitality brands, travel and hotel providers… can also lend themselves to contextual advertising that consumers opt into in exchange for more relevant and personalized experiences.”

Travel agencies are entering an increasingly competitive market. Home Depot, an established player that launched its RMN in 2018, recently rebranded it as Orange Apron Media and hosted what it called an InFront presentation for media buyers, modeled after TV upfronts, to attract more dollars from advertisers; and companies in other verticals, such as JPMorgan Chasehave also entered the fray recently.

Retail media networks have grown in popularity in recent years as retailers benefit from the scale afforded to advertisers by leveraging their owned media across their physical locations and e-commerce portals. Expedia has more than 20 years of experience publishing on more than 200 websites in over 70 countries, making it “a no-nonsense travel publisher,” said Angelique Miller, vice president of Media Studio at Expedia Group Media Solutions. Richard Nunn, CEO of MileagePlus United noted that 64 million passengers will be flown in 2023 and that it already runs ads on its in-flight screens. “We were already doing it in real life,” before launching Kinective, he said.

And the audience that travel networks can offer is very attractive. As Khosrowshahi explained to financial analysts, Journey Ads offers “a very, very high-end customer base” to advertisers and boasted about Journey Ads’ high engagement rate, with a 3% click-through rate.

Data Benefits, Educational Challenges

Travel companies are well positioned to compete for ad revenue because they have vast stores of data that give them insight into consumers, gathered through their loyalty programs. United’s MileagePlus has more than 100 million members worldwide, and Marriott’s Bonvoy has more than 196 million. “We obviously have a lot of data,” Nunn said, noting that the data is high-quality and verified, because traveler information must be accurate for a passenger to board a plane.

“With the advent of a cookieless world, it will be much more difficult for brands to track and target travelers across what has become a very complex journey,” Miller said. A company like Expedia, which relies less on third-party data, can reduce the impact of cookie abandonment, especially in an era when the purchase journey is highly fragmented, she said.

“As the way people seek inspiration, research and book travel evolves, we continue to adapt and innovate on behalf of our partners to meet these changes,” Miller said. She noted that Expedia Search According to one study, the average traveler views 141 pages of travel-related content more than 45 days before departure. “This fragmentation tells us all that it’s more important than ever to meet customers where they are,” she said. By using data to understand their habits and preferences, brands can make better decisions, she explained.

By connecting travel data, wait times—time spent waiting for a flight or traveling between the airport and a hotel—can be turned into opportunities, Nunn said. While a delay in arrival may be a hassle for a traveler, an advertiser can step in by providing useful information in that context, such as offering a traveler who is renting a home the ability to order grocery delivery in advance.

While destinations and other travel-related advertisers are making extensive use of travel NMRs, other types of brands can also benefit from the contextual advantage. Nunn noted that Kinective’s launch customers included both travel agencies and brands such as Chase and Macy’s.

“I think the opportunity with this owned media network is collaboration, not competition. That’s where publishers have failed in recent years,” Nunn said. He noted that for many brands, incremental media spend is being shifted to the same social media and search portals they’ve always used, while NMRs offer a more targeted opportunity.

The data-driven approach and data sharing raises some concerns about privacy and sharing proprietary information. As Miller explains, “Data protection is a major concern for anyone working in this space.” Many NMRs rely on data “clean rooms” that allow brands to collaborate while protecting data privacy.

Travel agencies also need to change their thinking about what they can do to accommodate different partnerships. Nunn noted that United has been testing with LiveNation and TicketMaster to offer ticket deals to travelers based on their destinations.

The biggest challenge for an NMR, Nunn said, is understanding the different audiences that need to be engaged when connecting media properties. “We’re an airline. A lot of these networks were built by retailers,” he said. Launching Kinctive required an outreach effort to “communicate the value of the data and the asset that we’re sitting on,” he said. “We had to say, ‘Why us?’”

“NMRs offer travel companies the opportunity to transform their loyalty programs from a cost center to a revenue opportunity, as well as monetize their websites, digital displays and other owned media channels,” said Genuin’s Wurst. “It’s really an opportunity to reclaim ownership of not just the data, but the content, the community experiences and the relationship with the consumer.”