A federal judge on Tuesday sentenced the owner of Bayville Adventure Park to 2 years in federal prison after he admitted to receiving more than $3 million in COVID-19 disaster funds by lying on online loan applications.

U.S. District Court Judge Joan Azrack said Donald Finley, 62, of Locust Valley, lived an “extraordinary and respectable life” but made a “series of very serious mistakes” that deserved to be punished.

“A message needs to be sent to would-be thieves and scammers who are running fraud schemes to steal critical relief programs,” said Azrack, who also ordered Finley to pay a $15,000 fine and complete 500 hours of probation. general interest work.

Finley, who also owned the now-defunct Jekyll & Hyde theme restaurant in Manhattan, pleaded guilty in May to fraud and wire fraud in Central Islip federal court. He admitted to inflating the payroll of his business entities and making other false statements to obtain additional funds while under intense financial pressure caused by the pandemic.

WHAT THERE IS TO KNOW

- The owner from Bayville Adventure Park of Long Island was sentenced to 2 years in prison for loan fraud related to COVID-19.

- Donald Finley62, of Locust Valley, pleaded guilty in May to stealing $3.2 million in small business loans through the Paycheck Protection Program and Economic Injury Disaster Loan program.

- Finley paid $3.2 million in restitution. He was also ordered to pay a $15,000 fine and perform 500 hours of community service as part of his sentence.

Prosecutors said Finley used the money for personal expenses, including buying a home in Nantucket, Massachusetts, in February 2021. Finley, who was accompanied to court by his wife and four children, is excused for his actions.

“These resources were intended to help this country recover from this catastrophic event and I have no excuse for what I did,” the businessman said.

Finley, who grew up in Freeport, operated several restaurants and theme parks on Long Island and New York between March 2020 and March 2021, when the fraud occurred, according to court records. He fraudulently applied for and obtained 29 Paycheck Protection Program and Economic Injury Disaster Loan Program loans, worth approximately $3.2 million.

Finley reported only $69,000 in wages for six employees at his legitimate businesses in 2019, the last full year before the pandemic, prosecutors said in court filings. When applying for pandemic relief, he reported a payroll of more than $4.5 million and presented falsified tax documents to support the fraud, prosecutors said.

The restitution was paid almost immediately after he was arrested and pleaded guilty, Assistant U.S. Attorney Mark Misorek said at sentencing.

“It’s a little more offensive than having to work really hard and pay it back,” Misorek said. “He didn’t have to commit this crime.”

Prosecutors, who had sought a sentence of 41 to 51 months in prison, said Finley was living in an 11,000-square-foot mansion on an 8-acre estate worth more than $7 million when he used more than $2 million in COVID relief to purchase the Nantucket property under his mother's name.

recommended readingBayville Adventure Park owner sentenced to 2 years in prison for $3.2 million COVID-19 loan fraud

“(He) chose to preserve his lavish lifestyle rather than do what most Americans have been forced to do during the pandemic,” Misorek wrote in a present note. “Most people have had to tighten their belts, do more with less, downsize and struggle. »

In his own memo to the court, Finley's attorney, Christopher Ferguson, of Manhattan, said his client abused alcohol and “found himself caught up in the hysteria and uncertainty of the pandemic, (committing ) an unusually terrible error of judgment.”

“(Finley) makes no excuses for his conduct,” Ferguson wrote. “He fully recognizes that others seriously affected by the pandemic have not broken the law. »

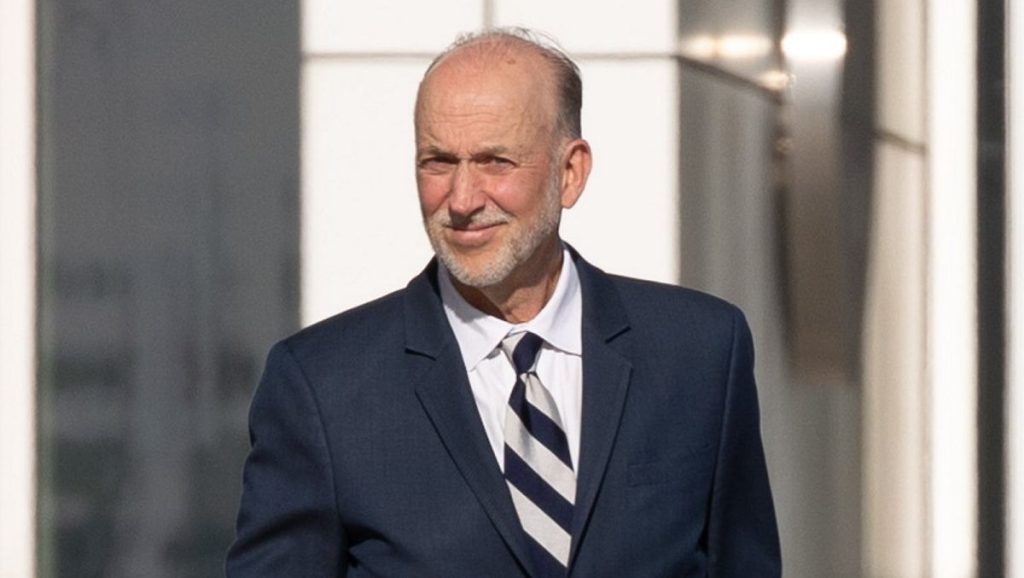

Ferguson declined to comment after the sentencing. Finley, dressed in a dark suit and striped tie, ran across the courthouse lawn to avoid speaking to the media.

Congress created the PPP and EIDLP as part of the Coronavirus Aid, Relief, and Economic Security Act of 2020 to provide emergency financial assistance to businesses impacted by the economic shutdown caused by the COVID-19 pandemic.

PPP loans are bank loans – used to pay payroll costs, mortgage interest, rent and utilities – that were forgiven by the federal government if certain criteria were met.

Finley's wife, mother and children all wrote letters to the court asking for leniency during sentencing. Azrack said she was moved by their support.

Finley, who remains free on a $500,000 unsecured bond, faced up to 30 years in prison for the charges to which he pleaded guilty. He is due to report to prison on June 17.

Finley is one of at least 20 residents of Nassau and Suffolk counties to be accused of defrauding federal business relief programs totaling nearly $50 million during the 2020 economic shutdown and in 2021, according to a Newsday report.

Finley had purchased the Bayville Adventure Park property in 2004, demolishing existing entertainment attractions before reopening two years later, he told Newsday in a 2013 interview. Ferguson said in his memo that Finley, from A middle-class upbringing “embodied the American dream.”

The park, which includes miniature golf, an indoor rock wall, bumper boats, a water slide and a “treetop” walkway, remains open, according to its website.